AI-Powered Stock Market Revolution: Unlocking Wealth in 2025

Artificial Intelligence (AI) is transforming the stock market, driving innovation in trading strategies, price prediction, and portfolio management. As we approach 2025, AI’s integration with financial markets is creating unprecedented opportunities for investors. This blog explores AI-driven trading bots, predictive analytics, portfolio optimization, and investment trends, drawing insights from sources like Forbes and FIU College of Business. The global AI trading market is projected to reach $54.6 billion by 2033, per Built In.

AI-Driven Stock Trading

AI trading bots are revolutionizing stock markets by automating trades with speed and precision. These algorithms analyze historical data, market sentiment, and news in real time, executing trades in microseconds. Groww notes that AI-powered high-frequency trading (HFT) accounts for over 60% of U.S. equity trading volume. Platforms like TradeStation and Interactive Brokers offer AI tools for retail investors, while India Today highlights risks like overfitting and regulatory scrutiny, requiring careful strategy calibration.

AI in Stock Price Prediction

AI models, such as neural networks, forecast stock prices by analyzing vast datasets, including earnings reports and social media trends. Forbes emphasizes AI’s ability to identify patterns, but The Hindu warns that market volatility and black swan events can reduce accuracy. Tools like BlackRock’s Aladdin combine AI predictions with human oversight, as noted by Investopedia, to balance risk and reward.

Portfolio Optimization with AI

AI enhances portfolio management by optimizing asset allocation and minimizing risks. Nasscom explains that AI-driven robo-advisors, like Betterment and Wealthfront, use algorithms to tailor portfolios based on investor goals. Traders Magazine highlights AI’s role in stress-testing portfolios against market scenarios, improving resilience. However, IMF cautions that over-reliance on AI models can amplify systemic risks during market downturns.

Investment Opportunities in 2025

AI-related stocks and ETFs are hot investment prospects. Nasdaq predicts strong growth for companies like NVIDIA and Palantir, while NerdWallet recommends ETFs like Global X Robotics & AI (BOTZ). Economic Times notes institutional interest in AI-driven financial firms. Investing.com highlights Astera Labs as a growth stock, despite market volatility.

Risks and Challenges

While AI offers immense potential, challenges persist. Forbes warns of regulatory risks, as governments may impose stricter rules on algorithmic trading. IMF notes that AI-driven HFT can exacerbate market crashes. Investors must diversify and monitor AI strategies, as advised by Nasdaq, to mitigate risks.

Conclusion

AI is reshaping the stock market in 2025, offering tools for smarter trading, prediction, and portfolio management. While opportunities abound, caution is essential. Stay informed to unlock wealth in this AI-driven era.

Welcome to ToolSnak.com – your one-stop destination for smart, simple, and free AI-powered tools designed to supercharge your writing and creativity.

How much did you enjoy AI-Powered Stock Market Revolution: Unlocking Wealth in 2025?

Related Articles

Jensen Huang's Strategic Moves to Maintain Nvidia's AI Leadership

Nvidia CEO Jensen Huang outlines plans to sustain the company's dominance in AI amid global challenges, including new technologies, partnerships, and geopolitical considerations.

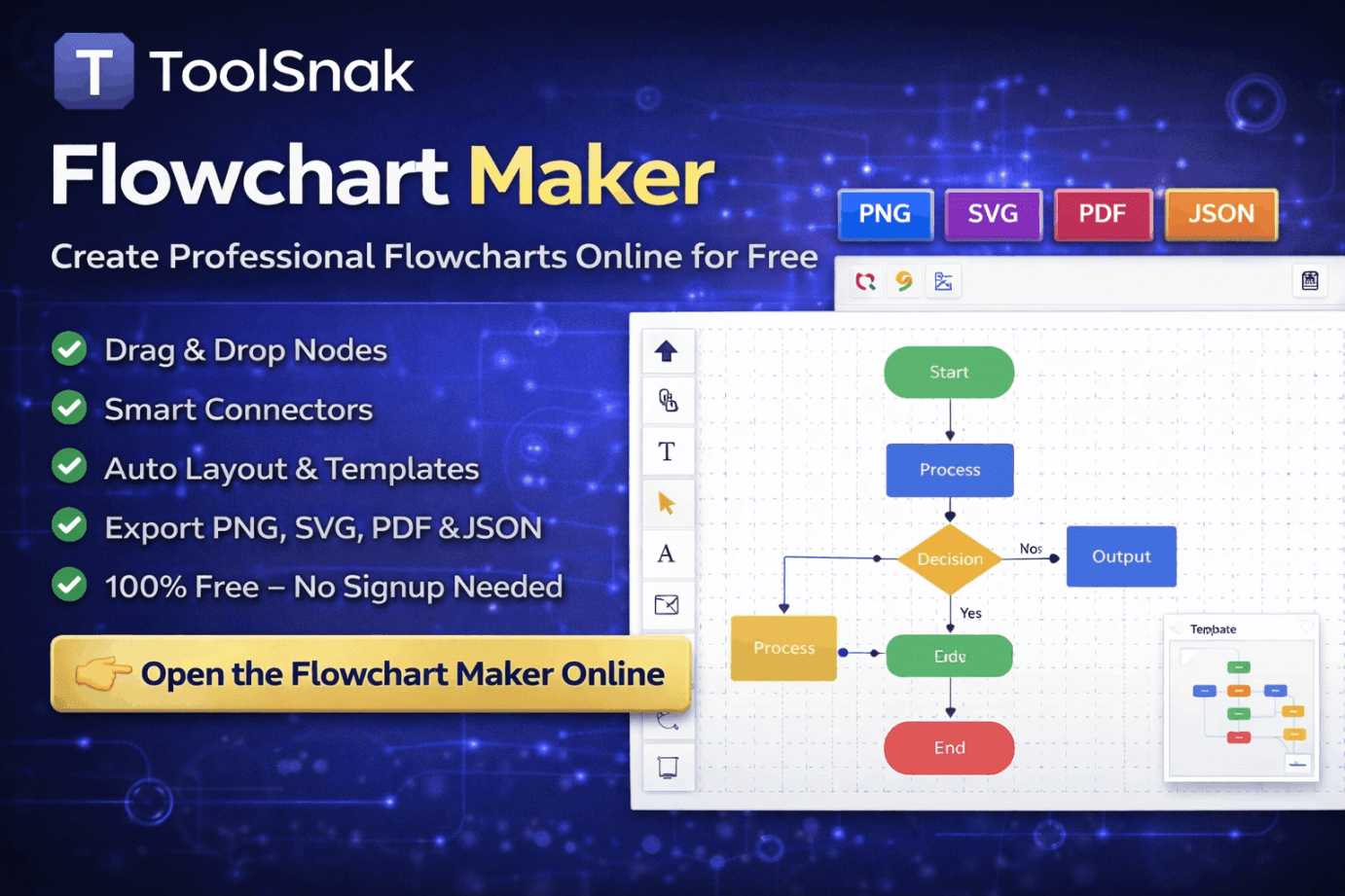

Flowchart Maker: Create Professional Flowcharts Online for Free

Create clear and professional flowcharts online using ToolSnak’s free Flowchart Maker. Drag-and-drop nodes, smart connectors, auto layout, templates, and export to PNG, SVG, PDF, or JSON.

Claude 4: Anthropic’s AI Revolutionizing Coding and Beyond

Explore how Anthropic's Claude 4 is setting new standards in AI with advanced coding capabilities, extended context understanding, and ethical considerations.

How to Use AI Token Counter & Tokenizer Tool

Learn how to use the AI Token Counter & Tokenizer in 2026 to count tokens accurately, optimize prompts, and stay within AI model limits.